The Buzz on Prf Insurance

Table of ContentsThings about Prf Insurance7 Simple Techniques For Prf InsuranceThe 8-Second Trick For Prf InsuranceSome Known Questions About Prf Insurance.Not known Facts About Prf Insurance

Ranch and also cattle ranch property insurance policy covers the possessions of your ranch as well as cattle ranch, such as livestock, equipment, structures, installations, and others. Think of this as industrial residential or commercial property insurance coverage that's exclusively underwritten for businesses in farming. These are the usual protections you can get from farm as well as cattle ranch home insurance policy. The equipment, barn, equipment, tools, livestock, materials, and also equipment sheds are useful properties.Your ranch and also ranch uses flatbed trailers, enclosed trailers, or utility trailers to haul goods as well as tools. Industrial vehicle insurance policy will certainly cover the trailer but only if it's connected to the insured tractor or vehicle. If something happens to the trailer while it's not connected, then you're left on your own.

Workers' settlement insurance policy gives the funds a staff member can utilize to acquire medicines for a job-related injury or disease, as suggested by the medical professional. Employees' compensation insurance policy covers rehabilitation.

You can insure on your own with workers' payment insurance policy. While buying the plan, providers will offer you the liberty to consist of or exclude on your own as an insured.

How Prf Insurance can Save You Time, Stress, and Money.

To obtain a quote, you can collaborate with an American Household Insurance coverage representative, chat with representatives online, or phone American Family 1 day a day, 365 days a year. You can file a case online, over the phone, or straight with your agent. American Family has actually stayed in business because 1927 as well as is trusted as a supplier of insurance for farmers.

And, there are a few various types of farm truck insurance coverage plans available. The insurance coverage needs for each and every kind of automobile vary. By investing simply a little time, farmers can expand their knowledge about the different types of farm trucks and also select the most effective and most economical insurance coverage remedies for each and every.

Whatever service provider is composing the farmer's auto insurance plan, heavy and extra-heavy trucks will certainly need to be placed on a business auto plan. Trucks labelled to an industrial farm entity, such as an LLC or INC, will certainly need to be positioned on a business policy despite the insurance provider.

All About Prf Insurance

If a farmer has a semi that is used for transporting their very own ranch products, they might have the ability to include this on the same industrial vehicle policy that guarantees their commercially-owned pick-up vehicles. However, if the semi is made use of in the off-season to carry the goods of others, many standard ranch and also business vehicle insurance carriers will certainly not have an "appetite" for this kind of danger.

A trucking policy is still an industrial car policy. The carriers who supply insurance coverage for procedures with lorries made use of to carry products for 3rd events are generally specialized in this kind of insurance. These kinds of operations produce higher risks for insurance providers, larger case quantities, and also a better seriousness of claims.

An experienced independent agent can aid you decode the sort of policy with which your industrial vehicle need to be guaranteed as well as content clarify the nuanced implications and also insurance coverage implications of having numerous automobile policies with numerous insurance coverage service providers. Some vehicles that are utilized on the ranch are insured on individual automobile policies.

Business automobiles check it out that are not eligible for an individual car plan, yet are utilized specifically in the farming operations offer a lowered danger to insurance provider than their commercial usage counterparts. Some providers opt to guarantee them on a farm vehicle policy, which will certainly have a little various underwriting standards as well as rating structures than a normal commercial automobile policy.

The Prf Insurance Ideas

Several farmers relegate older or restricted usage vehicles to this type of enrollment since it is an affordable method to maintain a car in use without every one of the added costs typically connected with autos. The Division of Transportation in the state of Pennsylvania classifies a number of various kinds of unlicensed ranch vehicles Kind A, B, C, and also D.

Time of day of usage, miles from the home ranch, and also various other constraints put on these sorts of vehicles. It's not a great concept to entrust your "day-to-day motorist" as an unlicensed farm car. As you can see, there are several kinds of farm truck insurance plan readily available to farmers.

The Of Prf Insurance

Please note: Information and also insurance claims presented in this web content are indicated for insightful, illustrative objectives as well as should not be taken into consideration lawfully binding.

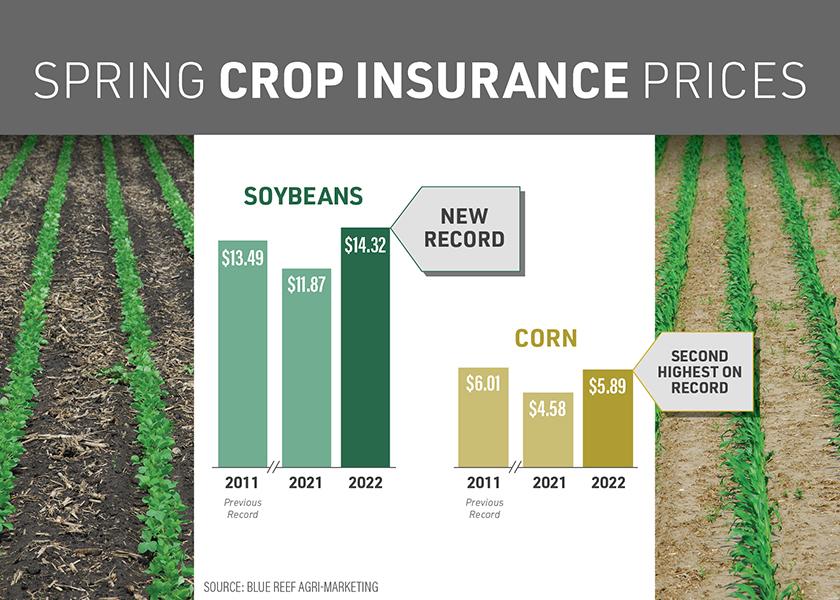

Crop hail storm coverage is offered by exclusive insurance companies and controlled by the state insurance departments. There is a government program giving a variety of multi-peril plant insurance products.

Unlike various other kinds of insurance policy, crop insurance coverage hinges on established days that relate to all policies. These dates are figured out by the RMA in advance of the planting period and also released on its website. Days differ by plant and also by region. These are the important dates farmers ought to expect to satisfy: All plant insurance applications for the designated county as well as crop schedule by this day.